Published Papers

We use facility-level panel data on CO2 emissions to investigate within-firm carbon leakage associated with Japanese regional emission trading systems (ETSs) at large-scale facilities in Tokyo and Saitama prefectures. A difference-in-difference analysis reveals that, relative to entities with no facility under ETSs, entities with regulated facilities have reduced emissions not only from these regulated facilities but also from unregulated facilities outside Tokyo/Saitama. This result indicates that regional ETSs serve as a turning point for entities to bridge the energy-efficiency gap. The data also suggest that a larger entity is more capable of reducing emissions from facilities in regions with less stringent regulations.

Preventing the occurrence of vacant houses and reutilizing existing vacant houses are two known ways of addressing housing vacancies. This study uses parcel-level data on single-family houses in the municipality of Toshima in Tokyo, Japan, to examine determinants of the occurrence and reutilization of vacant houses. The data reveal that, conditional on land prices, houses with restricted and costly redevelopment opportunities are more likely to become vacant. The results suggest that owners with such properties disregard the redevelopment potential and, as a result, tend to have a high reservation price relative to the market value. Consequently, owners face difficulty finding a transaction partner and even become reluctant to engage in a deal (i.e., they withdraw from the market). The results also suggest that revitalization of the neighborhood community may contribute to activating vacant houses. Local governments can use an empirical assessment such as this to implement efficient measures by targeting houses that have a high probability of becoming and remaining vacant.

The Japanese housing market has experienced a rapid increase in the number of vacant housing units due to regulatory obstacles and a decreasing population. Abandoned vacant houses can cause negative externalities in the surrounding neighborhood, due to illegal dumping of garbage, increased risks of arson, and building collapse. Few empirical studies exist that focus on the negative externalities of vacant houses, because of data limitations. This paper investigates these negative externalities by using a complete field survey conducted in the Toshima municipality, one of 23 wards in the Tokyo prefecture. We find that a vacant(single-family) house devalues nearby rental prices by 1-2 percent, on average. Vacant houses with property defects cause greater spillover effects. Addressing dilapidated vacant housing with overgrown vegetation and combustible materials would likely produce annual tax gains greater than one million yen (approximately nine thousand U.S. dollars) per vacant housing unit. Given the substantial number of existing vacant houses, local governments should identify the types of vacant houses causing the most severe negative externalities based on empirical assessment and implement efficient countermeasures to address the issue.

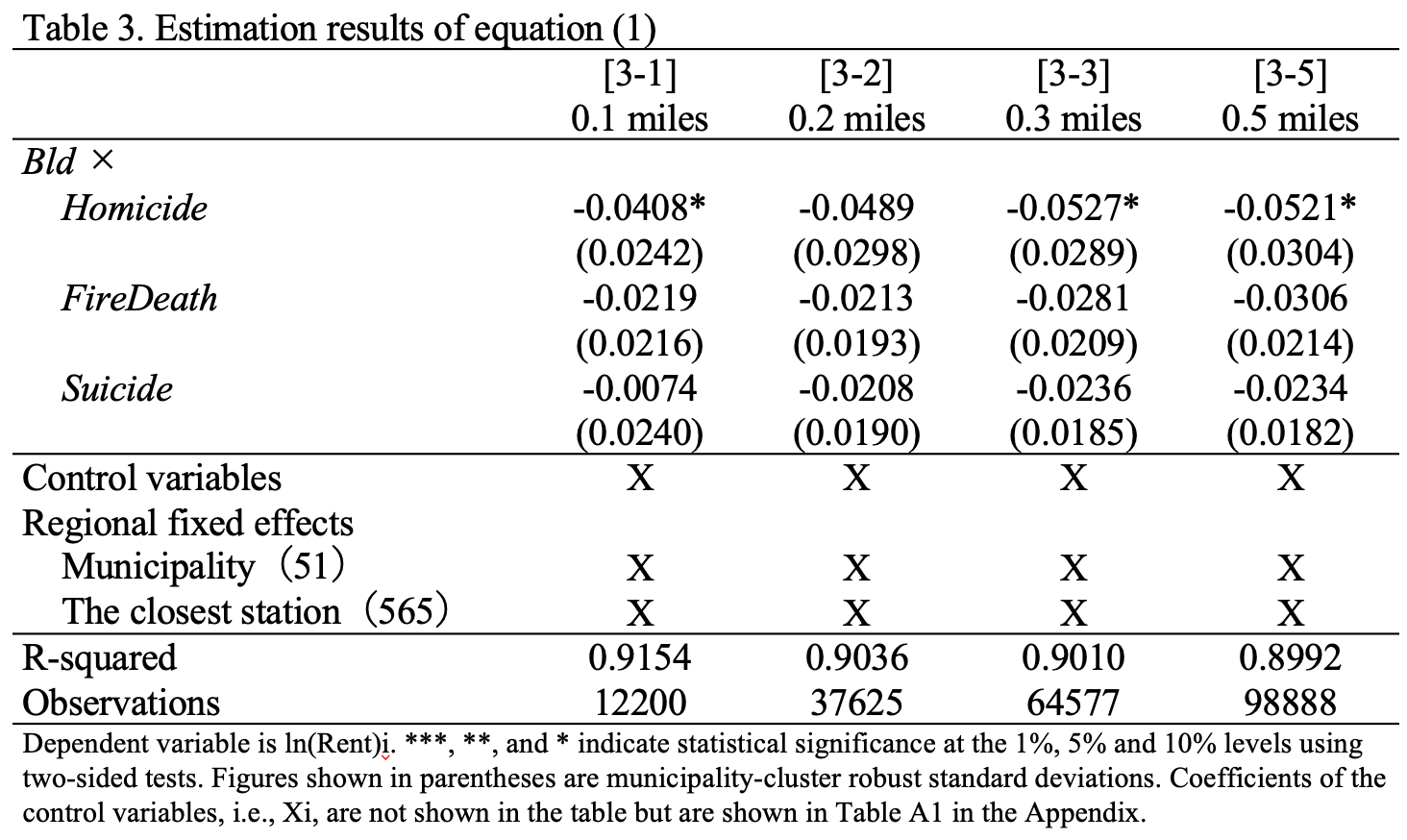

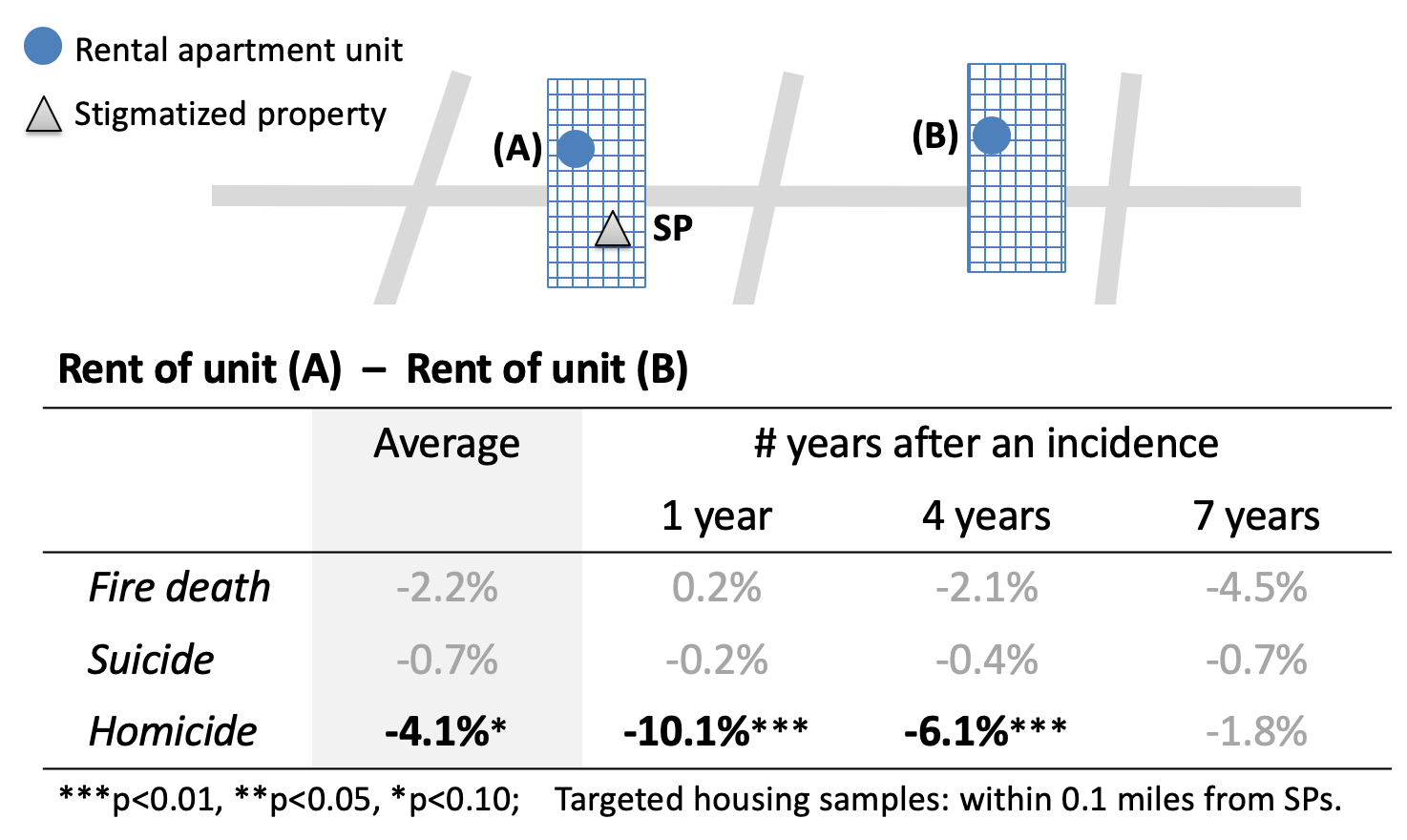

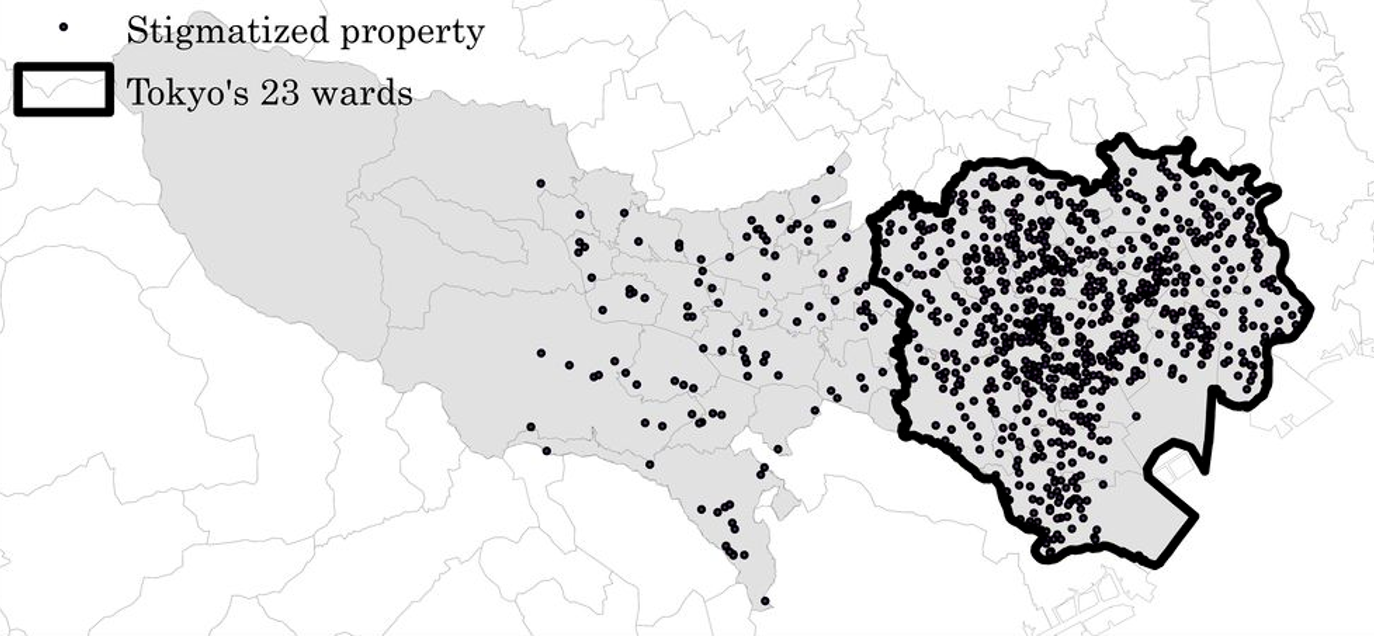

The presence of a stigmatized property due to undesirable mortality incidents, such as homicide and suicide, may affect people’s willingness to pay to live in that particular neighborhood. This paper applies a hedonic approach to examine the externality of stigmatized property using data from Tokyo, Japan. By carefully considering detailed regional fixed effects, the estimation results reveal that an incident of homicide occurring in an apartment unit lowers the rents of nearby units in the same building by approximately 10% immediately after the incident, but the impact is ameliorated gradually over time and disappears after approximately 7–8 years. We do not find any evidence of a negative externality in cases of suicide or death by fire. These results suggest that under the current Japanese legal system, a recent homicide occurring at a property in an apartment building should be disclosed to potential buyers/renters of different units in the building.

Purpose

The purpose of this paper is to provide new empirical evidence on the important role of market transparency in international real estate investment.

Design/methodology/approach

The authors apply the augmented panel regression method (or the correlated random effects approach) by using national panel data from 44 countries from 2004 to 2016.

Findings

Countries with better accessibility to market information and higher enforceability of regulations have less information asymmetry and attract more inward real estate investment. In contrast, the accounting quality of corporate governance is negatively correlated with investment, indicating the possibility that foreign investors enjoy high excess returns by investing in real estate in countries with poor accounting quality.

Practical implications

Countries lacking market transparency can increase inward investments by providing richer market information to foreign investors and by boosting enforceability of regulation to mitigate the uncertainty of returns on investment. Investors and public sectors in countries facing a saturated real estate market may expand investment by investigating less-explored markets and by seeking bilateral negotiations to secure higher predictability of return on investment in targeted countries.

Originality/value

The authors utilize updated multiple transparency indices instead of a conventional aggregate index to examine how the investment is attributed to different aspects of market transparency and employ the augmented panel regression method for investigation of the intra- and international determinants of the investment.

Geographical relationships between a housing unit and its major surrounding sites, such as public transportation stops and crime scenes, are fundamental factors that determine housing value. This paper proposes a new parametric approach to estimate the aggregate spatial effect of multiple heterogeneous sites while providing fruitful interpretations of the effect of each of these sites. While the proposed method is developed based on a traditional accessibility measure, the way in which it addresses the role of the proximity order of sites in the spatial analysis is novel. The method is applied empirically using rental housing data in Tokyo, Japan to examine how the clustering of train and subway stations influences the rental prices in their vicinity. The results reveal a discounting impact of the order of each station’s proximity, even after controlling for the effect of distance. In addition, the results reveal that using a traditional accessibility measure without considering the proximity order leads to serious estimation biases. The proposed methodology is applicable to various spatial topics, such as transportation, neighborhood externalities and polycentric urban structures.

Condominium reconstruction involves a difficult collective decision-making process among owners, which prevents older condominiums from being redeveloped efficiently. This paper aims to examine whether this type of collective action cost exists for Japanese condominiums. First, we discuss in literature review and an empirical analysis that the number of units in a condominium complex is an appropriate proxy for the collective action problem. Then, by using the rent in the price function to control for housing characteristics, we show that the number of units has a negative impact on condominium price. Furthermore, the price function for condominiums is compared with that for single-owner rental apartments that are free from collective action problem. The estimation results show that the number of units negatively affects only the price of condominiums and that the depreciation rate for the condominium price is greater than the rate for single-owner apartments. This finding is consistent with the hypothesis that a significant cost is associated with collective action problems in condominium reconstruction. Lastly, we conduct a comparative examination of condominiums in Japan and the United States and the result suggests that revising current Japanese condominium law could induce more efficient redevelopment of old condominiums.

This paper empirically investigates the costs that arise from uncertainty in the college-town housing market in the Urbana-Champaign metropolitan area, the home of the University of Illinois. This research resulted in two principal findings. First, the rental price of housing owned by property owners having more than 10 claims filed against them (i.e., complaint records on violations of property owners’ obligations under the law or according to the terms of the lease contract) in the past five years was about 10% lower than the rent for other housing. Second, because of the uncertainty involved in renting from a potentially risky property owner in an unfamiliar location, a large number of graduate students choose to live in housing provided by the university (hereafter termed university housing), which costs at least 45% more than they would pay a private property owner. These two results shed light on the prominence of uncertainty in college-town environments and show that university housing plays an essential role in the housing market by alleviating such uncertainty. Although there have been movements to privatize university housing at some institutions, without the engagement of the university, the college-town housing market would face the serious risk of being exposed to the uncertainty owing to the asymmetry of information between renters and private housing providers. Conversely, further expansion of the housing business by the university could yield greater efficiency in the college-town housing market.

Book Chapter

This chapter estimated the impact of the Tokyo emissions trading scheme (ETS) and Saitama ETS on energy consumption in the manufacturing sector using a facility-level panel data set compiled from the Current Survey of Energy Consumption, a nationwide survey on energy consumption conducted by the Agency for Natural Resources and Energy in Japan. To our knowledge, no study has used this rich data set to perform sophisticated econometric analyses. We found that the Tokyo ETS reduced electricity consumption by 16%. On the other hand, we did not find evidences of switching from dirty fossil fuel to cleaner fuel associated with the introduction of the Tokyo ETS. The impact of the Saitama ETS on energy consumption was not statistically confirmed based on our samples. Additional studies are needed to identify the different impacts of the ETSs between Tokyo and Saitama. We also found that Japan has been experiencing long-term decreasing trends in the number of manufacturing facilities and the volume of fossil fuel consumption, which may reduce Japanese CO2 emissions in the long run.